The stock market is open for a half day and the folks at CNBC are covering the day's trading.

Erin Burnett just asked a guest the following question (I'm paraphrasing):

"It seems the last 8-10 years of economic gains - home sales, increases in stock values, consumer sales, everything - was ephemeral...built on debt with people spending money they didn't actually have. Does this mean we have to go back to 1998-2000 levels of wealth before we finally bottom out in the economy?"

The answer is, we'll be lucky if we only retrace to 1998-2000 levels of wealth before this economic mess is all over.

Let's look at the latest economic news to see where we are so far:

Existing home sales fell sharply last month while inventories increased. Home prices fell at a record rate - in the last year, the median sales price of existing homes fell 13.2%, the most since the Great Depression. Existing home inventories are at a 25-year high. Mortgage applications did increase last week as mortgage rates fell

but most of those are refinancings, so we shouldn't expect those home inventories to fall or prices to stabilize any time soon.

Many on Wall Street and in Washington were hoping that modifying mortgages for homeowners under duress would help stabilize foreclosures -

only it hasn't happened and homeowners with modified mortgages continue to default at alarming rates:

WASHINGTON (MarketWatch) -- More than half of mortgages modified in the first quarter were at least 30 days delinquent after half a year, and it's necessary to figure out why so many modifications are not preventing re-defaults, regulators said Monday.

The proportion of modified loans delinquent by 30 days or more was 55% after six months, according to the Office of the Comptroller of the Currency and the Office of Thrift Supervision. Modified loans that were 30 or more days delinquent after three months stood at 37%, the agencies' data showed.

"One very troubling point is that, whether measured using 30-day or 60-day delinquencies, re-default rates increased each month and showed no signs of leveling off after six months and even eight months," said Comptroller of the Currency John Dugan.

On the jobs front, the economy has lost nearly 2 million jobs since December 2007.

First time applications for state unemployment benefits are at the highest levels in 26 years and according to Marketwatch

The jobless claims report shows businesses are laying off workers at a rapid pace, and finding a replacement job is ever harder for those who have lost their job.

...

The insured unemployment rate -- the proportion of covered workers who are receiving benefits -- was steady at 3.3%, the highest in 16 years.

Initial claims represent job destruction, while the level of continuing claims indicates how hard or easy it is for displaced workers to find new jobs.

The initial crisis in the housing market was creating by banks handing out adjustable rate mortgages and so-called liar loans to people who weren't credit worthy and who started to go belly-up when their ARM's adjusted to higher rates. But with unemployment accelerating, some analysts worry that even homeowners with good credit will default on their mortgages (as is already happening) and eventually lose their homes to foreclosure, further exacerbating the housing crisis and plunging home values well below the 2004 levels they have currently hit.

Earlier this week,

the Wall Street Journal reported that developers of commercial real estate are begging for government bail out money as thousands of office complexes, hotels, shopping centers and other commercial buildings are headed into defaults, foreclosures and bankruptcies.

Manhattan has been hit very hard, with the office rate hitting 10.9%, the highest in two year and 3 percentage points higher than last year.

Hotel occupancy rates have fallen nationwide and delinquency rates are increasing.

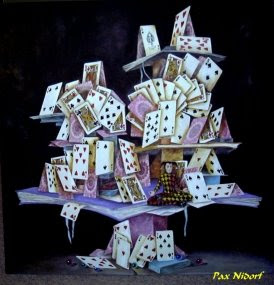

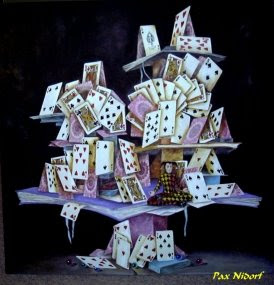

The stock market slide has stopped for now, with the Dow hovering at 8400,

down more than 36% this year. Plenty of market prognosticators are calling a bottom to the market, but you can bet the Dow would have fallen well below 8000 had taxpayers not bailed out financial firms like Citigroup, AIG, Goldman Sachs and the like and you can bet that as the housing and unemployment pictures continue to worsen and the financial firms blow through the TARP money and come back for me that the markets will fall again.

And who knows what inflation rates are going to be like in the years ahead as the trillions of dollars the Federal Reserve has printed and circulated into the economy fan prices.

Remember the double digit inflation of the late 70's and early 80's? You shouldn't be surprised to see that again in a few years. Sure, it's possible the boys at the Federal Reserve will figure out how to pull that extra cash out of the monetary system before rampant inflation hits, but they surely haven't inspired confidence in the way they have handled the financial crisis so far so I wouldn't bet the mortgage on it.

So 2008 comes to an end, a year in which we saw the socialization of risk for investment banks, commercial banks and other financial firms (total cost of TARP bailout and other Federal Reserve "infusions of cash" into the system

- $8.5 trillion dollars) even as the privatization of profits for these firms continues (

pay back the bonuses based on phony profits from past years? NOT!!!). Home values are at 2004 levels and look like they will continue to plunge further in the next year. Job losses are accelerating, further trouble for the housing market as even solvent homeowners default on their mortgages after they lose their jobs. Ponzi schemes like Bernie Madoff's little venture are being exposed

and the costs calculated even

as people who are tied to these schemes end up in the morgue.While all this carnage listed above sounds terrible, I think it's about time that the go-go Bush years - built on the accumulation of trillions of dollars of debt, overleveraging, the socialization of risk, greed and a lack of accountability at ALL levels of society but especially for the top 1%, the so-called MASTERS OF THE UNIVERSE - fade and a new era of humility, accountability and a less is more attitude be ushered in.

As Todd Harrison wrote on Marketwatch this week:It's long been my belief that a stealth recession has existed for many years, masked by the lower dollar and skewed by the spending habits of a slimming margin of society. That created a de-facto two-class society of haves and have-nots that persisted until the age of austerity arrived this year.

The combination of involuntary thrift -- when people can't afford basic necessities -- and voluntary thrift - when folks with money choose not to spend -- created a perfect storm for the consumer and industries dependent on them.

The conspicuous consumption that once defined our immediate gratification society has passed as flashy rides and outrageous lifestyles now serve as hollow reminders of misplaced priorities.

And that is my hope for this holiday season - that the misplaced priorities and immediate gratification that so many of us have seen as our entitled legacies as Americans shift to a more humble, spiritual way of living less concerned with accumulation of wealth and more concerned with gratitude, service and love and care of others and this earth we live on.

This is an abundant universe we can avail ourselves to if we stop allowing ourselves to be blinded by short-sighted greed and selfishness.

But since the new stewards of our economy

look pretty much like the old stewards of our economy, I guess I shouldn't hold my breath.

Happy holidays everybody.